Tri-State Generation and Transmission Association announced last month that it will close its coal plants in Colorado and New Mexico and build a gigawatt of new wind and solar projects, in a move that its CEO said will “transform Tri-State as a power supplier.” Tri-State CEO Duane Highley explained that replacing coal with renewable energy will reduce costs as well as carbon emissions, as the power supplier submits its plans to Colorado regulators this year.

Wind and solar prices “way, way below” two cents help accelerate coal retirements

At a press conference in the Denver State Capitol with Colorado Governor Jared Polis, Highley explained how the dramatic declines in renewable energy prices enable Tri-State to reduce costs by replacing coal plants with new wind and solar projects:

“This is what’s amazing and why this is an exciting time for our business. We’ve seen the cost of renewables plummet. From the first renewable project we signed ten years ago, we’re seeing like an 85% reduction in the cost of solar energy. And because the wind and solar energy now comes in prices lower than the cost of generating with any fossil fuel, coal or gas, it provides us with an opportunity, if you want to call it a “green energy dividend,” that those savings in energy costs can be used to help us accelerate the retirement of coal and pay for that accelerated retirement, without negative rate impacts.”

Highley’s comments confirmed what a variety of analysts have found over the last two years. A pair of reports by Moody’s Investors Service in 2018 found that “most municipal and G&T cooperative-owned coal power plants have operating costs greater than the all-in cost of renewables,” including Tri-State’s coal plants, and highlighted how “high quality renewable resources” in Tri-State’s and Basin Electric’s service territories “may enable these utilities to reduce rates for their customers where the price of new renewables undercuts that of existing coal.” A report by the Rocky Mountain Institute later that year found that Tri-State’s member co-ops could save hundreds of millions of dollars by replacing coal with renewable energy.

Tri-State did not provide pricing details about its new wind and solar projects, but Highley told Colorado legislators at an energy hearing last July that its previous request for proposals “resulted in costs well below two cents for both wind and solar, I mean well below, I mean way, way, below. Lower costs than what we can get at variable cost from operating any fossil fueled unit. So I’m expecting that to be the case again.”

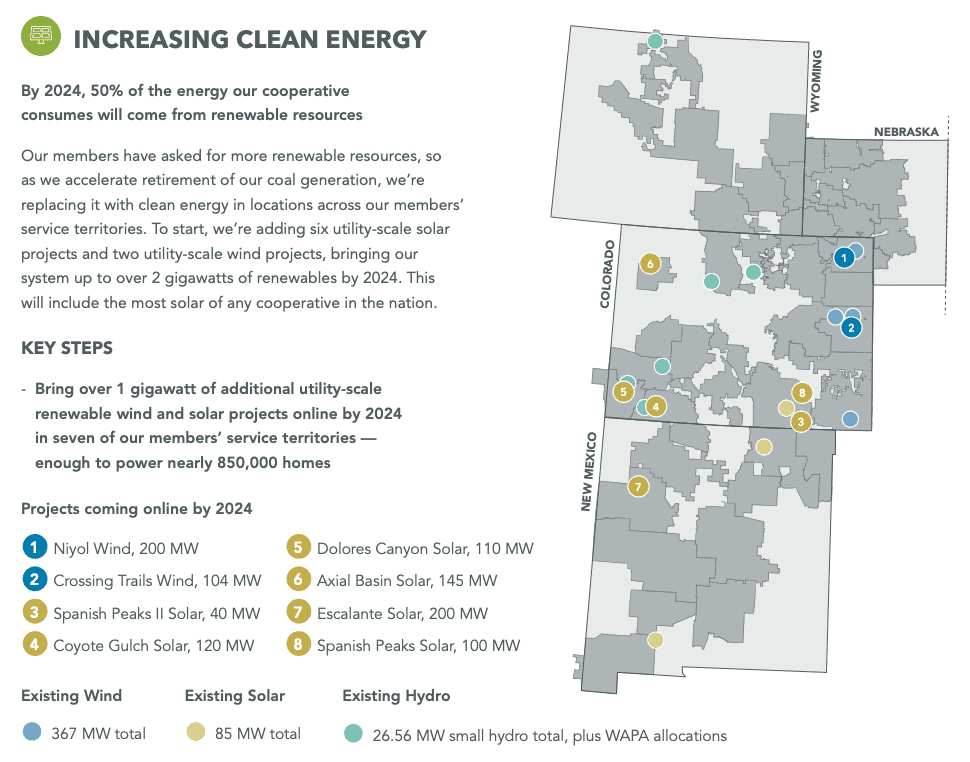

Tri-State will build a gigawatt of new wind and solar, reaching 50% renewable by 2024

Tri-State announced 304 megawatts of new wind projects and 715 megawatts of new solar projects in Colorado and New Mexico. Tri-State said that by replacing coal plants with those new renewable projects, along with existing wind, solar, and hydroelectric projects, “by 2024, 50% of the energy our cooperative consumes will come from renewable resources.”

The new wind and solar projects that Tri-State announced will be built in the service territories of seven of Tri-State’s member co-ops, and two of the solar projects will be built at coal facilities that Tri-State will close.

In Eastern Colorado, Tri-State announced the 200 megawatt Niyol Wind project in Highline Electric service territory, along with the previously announced 104 megawatt Crossing Trails Wind project in K.C. Electric service territory.

In Southwest Colorado, Tri-State announced the 120 megawatt Coyote Gulch Solar project in La Plata Electric service territory, and the 110 megawatt Dolores Canyon Solar project in Empire Electric service territory. Tri-State also announced it would add another 40 megawatt solar array to the previously announced 100 megawatt Spanish Peaks Solar project in San Isabel Electric service territory in Southern Colorado.

Tri-State also announced the 145 megawatt Axial Basin Solar project on its Colowyo coal mine land in Northwest Colorado, as well as the 200 megawatt Escalante Solar project at the site of its Escalante coal plant in Eastern New Mexico.

Tri-State will close over half of its coal fleet

Tri-State announced that it would close its Escalante coal plant in Eastern New Mexico this year, and the larger Craig coal plant in Northwest Colorado by 2030. Along with the closure of the Nucla coal plant last year, those closures represent 1001 megawatts of coal capacity, or about 53% of the total 1884 megawatts of coal capacity that Tri-State owns.

The Colowyo coal mine, which supplies the Craig coal plant, will also close by 2030. Tri-State detailed the costs associated with the closures of its coal plants and mine in a filing with the Securities and Exchange Commission.

Tri-State did not announce any plans for its ownership interests in coal plants operated by other utilities, the Springerville coal plant in Arizona and the Laramie River coal plant in Wyoming.

While the full Craig coal plant will close by 2030, Unit 1 will close by 2025 as previously announced. Tri-State also said that it “is working with the other plant owners to determine the specific details for the retirement of Unit 2.” Tri-State operates the Craig plant, but is a partial owner of Units 1 and 2 along with four other utilities, including some that have pressed for an earlier closure. The other owners include Xcel Energy, PacifiCorp, Platte River Power Authority, and Salt River Project, each of which has announced emissions reductions plans, accelerated closures of coal plants, or both.

Tri-State also said “we’re committing not to add more coal to our system,” and announced that it had formally canceled its efforts to expand the Holcomb coal plant in Kansas. That project had been effectively dead for years, and Tri-State acknowledged in 2017 that it was unlikely to move forward. The Wichita Eagle reported that Sunflower Electric, the utility which operates the existing Holcomb coal plant, said it had “supported Tri-State’s efforts to market the permit to other utilities” – but that no utilities were interested in purchasing the permits to build a new coal plant. At a meeting in 2017, a Tri-State director predicted as much, explaining that “the board has voted to get out of Holcomb. So there’s the possibility that we could sell it, but I don’t know who would want to buy it. I don’t think there’s going to be any coal plants built.”

Although no new coal plants were likely to be built, Tri-State’s commitment “not to add more coal to our system” also means that Tri-State won’t increase its ownership stake in existing coal plants, which it did as recently as 2018 when it boosted its share of the Laramie River coal plant in Wyoming.

Colorado regulators could seek more aggressive carbon emissions reductions

Tri-State said that its plan will achieve a “70% reduction in CO2 emissions associated with Colorado wholesale electric sales” by 2030, from 2005 levels. That approaches, but does not quite meet, the 80% cut in carbon emissions by 2030 that Colorado’s climate legislation urges for electric utilities.

Colorado regulators could seek more aggressive emissions reductions from Tri-State. At a January 22 Colorado Public Utilities Commission meeting, commissioners and staff discussed the process for Tri-State’s upcoming electric resource plan (ERP), and commission staff recommended:

“We suggest that a single scenario be required in Tri-State’s rules for its initial ERP filing and following filings, and that would be to require an assessment of the costs and benefits of early retirements of utility owned resources and the acquisition of new utility resources, required to reduce the carbon dioxide emissions associated with the utility sales by 80% from 2005 levels by 2030.”

Commissioners unanimously approved that recommendation.

Tri-State did not say how much its system-wide emissions will be reduced under the plan. Colorado accounts for about two-thirds of Tri-State’s electricity sales to member co-ops.

Negotiations with La Plata Electric and United Power continue

While the clean energy announcement brings Tri-State closer to meeting Colorado and New Mexico’s climate and clean energy policies, it’s not yet clear what it will mean for the power supplier’s negotiations with some of its largest member co-ops. At the press conference, Highley said that “with this announcement, we are meeting the stated sustainability goals for every one of our member systems” and expressed hope that its member co-ops would consider staying with Tri-State.

United Power and La Plata Electric have requested that the Colorado Public Utilities Commission determine the price they would need to pay to end their contracts with Tri-State, as Delta Montrose Electric has done. In a press release responding to Tri-State’s announcement, La Plata Electric CEO Jessica Matlock said, “While Tri-State’s future goal will help meet our carbon reduction goal, we do not yet know what the costs of its plan will be to our members and what LPEA’s role will be for producing local, renewable energy into the future.”

At the press conference, Highley pointed to an upcoming option that Tri-State hopes will help address some its member co-ops’ concerns about Tri-State’s restrictions on local energy development:

“The work of our contract committee will be announced in April. And at that time we’ll have a block of energy available for our members to bid to self-supply. To the extent that our members develop local renewable projects, it will take some pressure off the remaining development for Tri-State, but if you look at the total Responsible Energy Plan, by 2030, as we look at a goal of 90% reduction in carbon emissions in Colorado, it’s going to involve the construction of thousands of megawatts of new renewables. So more than double what we’re announcing today, yet to come.”

[…] a power supplier for electric cooperatives in Colorado, Wyoming, New Mexico, and Nebraska, that plans to replace some of its coal plants with new renewable energy projects. Tri-State is the third […]